Assurance. Confidence. Legal Certainty.

The Legal Process for Purchasing Real Property in Mexico

Buying a home Mexico is a big step! Whether you're buying your first vacation home, your ultimate dream home, or your tenth investment property, this will be a big investment.

Finding the perfect property is just one way we can help you with your real estate purchase. As highly skilled and experienced real estate agents in Mexico with more than decade of demonstrated success. Global Real Estate Team has become known as the trusted, and experienced professionals that deliver on their clients needs time and time again. We know how important this is to you, and we will guide you through. We know the Mexico real estate market and we we'll educate you throughout the buying experience.

This is a simplified summary of the ordinary closing process for real estate transactions in Mexico (within 50km’s of the beaches, considered the Mexican Trust Bank process).

Mexico's Closing process:

Step 1. Due diligence on real estate property and offer/promise to purchase. 3t o 8 days.

Step 2. Removal of conditions, escrow deposit or down payment to seller. 2 to 5 days (unless otherwise agreed)

Step 3. Closing cost estimate to buyer 3 to 7 days.

Step 4. Providing personal and additional information of the parties. 2 to 5 days (unless otherwise agreed)

Step 5. Deed process (title of property) and execution of the deed before a Notary Public. Typically 45 to 90 days (unless otherwise agreed). [Note: once the new deed has been signed, and you’ve taken possession of your new property, it’s yours. You will receive a simple copy of your deed and a letter from the Notary that your ownership title is in the title recording is in process with land registry. (Proof of legal ownership pending land registry completion where the Public Registry / Land Title Office officially registers your property.) The deed goes on a journey collecting stamps and signatures and finalizes this process at the official Public Land Registry office. The Notary or Closing attorney should contact you that your completed land registry documents and deed is ready for pickup.

Step 6. Deed recording process before the Municipal / State Government offices. 60 to 90 days or more (depending on Government offices agenda).

Note: If wishing to purchasing through a legal entity such a Corporation in the either the USA / CANADA or MEXICO additional documentation and process to complete is slightly more involved than the individual purchase. Please contact us for more details.

GENERAL CLOSING PROCESS & COST OVERVIEW PUERTO VALLARTA JALISCO & RIVERIA NAYARIT

It is important to be aware that the process of purchasing a property in Mexico is different than that of Canada or the United States.

In Mexico is a Notary referred to in Spanish as a (Notario) is an institution different to a Notary in Canada or the United States. A Notario in Mexico is a state-appointed, experienced, and knowledgeable lawyer specializing in real estate transactions whose main activity and obligation is to carry out the process of transferring title of properties and collection of taxes owed to the government. By law, all real estate transactions must be processed through a licensed Notario office. Please note: Notario’s are considered Neutral parties in real estate transactions so its common practice to have an external closing attorney be involved in the real estate transaction.

Closing Attorneys are frequently used in conjunction with Notario offices as they provide more comprehensive and personalized service for client’s and most importantly; work for the clients best interest.

The following is a useful explanation of the typical real estate closing costs for property transactions in Puerto Vallarta Jalisco and Riviera Nayarit.

Closing costs in these areas of Mexico usually amount to approximately 5% - 9% of the purchase price of a given property depending on purchase value, what is required for the specific property, and current rules. This amount is divided into a fixed 2.9% acquisition tax and registration fee paid to government offices, plus approximately $10,000 USD in set fees that include the real estate Trust, Notary fees, Lawyer to review everything for your best interest, tax appraisal, permits and escrow fee.

Since some are based on purchase price and some are set fees, calculating the closing costs as a % of sales price can be lower for higher value property purchases or higher for lower priced properties due to fixed costs that are not based on a percentage of the property value. You would pay your Lawyer, or the designated Notary and they would pay the various costs for you.

These closing costs are paid by the purchaser. For convenience and to ensure a smooth transaction Purchasers typically send 50% of the estimated closing fees to the corresponding legal office (known as a closing cost deposit) to pay these fees on the Purchasers behalf. The final costs can vary slightly if there are any changes to governmental fees, as outlined below, between the moment you receive an estimate and the actual closing day.

Payment of the remainder of closing costs are due the week before the closing date, when the Deed/Property Title will be signed and transferred to the Purchaser/Trust Bank. On this day, the Notary will give a purchaser a simple copy of the title to their property.

The fully recorded Deed (duly registered with land title office called - The Public Registry Office) original documents with all the government’s stamps and receipts can take a minimum of 120 to 280 days after the closing date to be duly recorded with the Public Registry (Land Title Office) in Mexico.

Your closing Laywer will work very closely with the Notario to obtain all the pertinent original documents related to your title for your records as soon as they are ready.

Costs break down: Note: Some percentages vary depending on the state in which the property is located. The following is based on Nayarit state.

1) TAX OFFICE REGISTRATION: This is a transfer of property tax. This is paid by every purchaser to the local government. It is 2% of the purchase price. As opposed to the US where state and local government collect annual property taxes which are very high and even astronomical in some areas. In Mexico the authorities charge this 2% at the beginning. In contrast, they do not charge high annual property taxes. The Notary is responsible to collect this tax; the Notary is also personally liable for failure of doing so. [Sending closing costs deposit to your lawyer is often the best course of action as the easiest for you, and the lawyer will send the transfer taxes to the notary.]

2) REGISTRATION FEE: This is a tariff of approximately 0.9% paid to the Office of the Public Registry for land titles registration. In this office, as per Mexican law, all deeds (including property’s deed of trusts) must be registered. Canada and the United States have something similar. It is the obligation of the Notary to do the process of registering your property in this office. The legal aspect of the Public Registry is to acknowledge in the Public Records office that you are the owner of the trust rights of the said property from the purchase date. This way you are protected against claims that the seller may have had prior to the sale of the property. This item is related to the search of liens and encumbrances and its corresponding certificate, as explained below.

In the above two items you have 2.9% of the total percentage (of the closing costs mentioned above) that will be added to total closing costs.

MISCELLANEOUS, CATASTRO (PROPERTY TAX OFFICE) APPLICATION AND REGISTRY OFFICE COPY.

Once you have signed the deed and trust documents, the documents are not only registered in the Public Registry but also at the Municipal level in the CATASTRO (cadastre) OFFICE for two purposes: one for census, that is to register new construction, locations of properties and also for the annual property tax assessment. The Catastro office is a local office. At registration they will give you a property tax number (Registro Predial). Properties taxes are to be paid every year at the beginning of the year and is called Impuesto Predial (property tax). It is important to remember that the city will not necessarily send you a tax bill, however, it is your obligation to go to make your payments annually. You can pay property taxes online, in person at the various Tsesoria offices, or ask your property manager to pay for you and send you a copy of the reciept. Property taxes are due every January, and the municipality normally offers a discount to the annual tax if paid within the first month of the year.

3) TAX VALUE APPRAISAL: This appraisal is done by a bank and municipal authorized Appraiser, normally a civil engineer. Appraisers are normally chosen by the Notary themselves and they may be working with different, if not all, Notaries of the area. The appraisal is not for commercial purposes, ie: to establish a market price, rather it is for property tax purposes and is mandatory as part of the purchase process. The figures given are normally lower than the market values. For tax purposes, the law establishes that the value chosen by the municipality to base the property tax is the higher of the two of the prices established in the purchase agreement or the appraisal. So, it may be the case that the property is appraised at 10 pesos, and the purchase agreement established the price of 1 peso, the municipality will take the appraised value as the base for the property tax. The other way around, the purchase price is 10 pesos, and the appraised value is 1 peso, the municipality will take the purchase price as the base for the property tax. It’s at their discretion.

4) THE CERTIFICATE OF NO LIENS AND ENCUMBRANCES: The Notary will do document research in the State Public Registry and municipal CATASTRO office and get a history of the property. This history is written in the deed of trust as background information. The search is for the purpose of finding liens and encumbrances that may hinder the transfer of the property to third parties that are purchasing in good faith.

The Notary will also search at the municipality if the property is current with all property tax payments. If there are no liens or encumbrances nor outstanding property tax amounts owing, the deed will be authorized to prodded to the next step in the process. The corresponding CERTIFICATE OF NO LIENS AND ENCUMBRANCES issued by the Public Registry and THE CERTIFICATE OF NO OVERDUE TAXES issued by the municipality are annexed to your deed of trust. Similar certificates are acquired for water and property taxes to ensure there are no past due amounts.

5) THE TRUST FEES: These are the fees related to setting up a trust. The process is as follows: a) Previous to drafting the deed of trust, the Notary will request a permit from the Federal Foreign Affairs office to set up, as per the law, a Trust and its corresponding deed for the benefit of the named buyer. b) The Office will grant the permit and then the Notary will request the bank to set up the Trust and draft the Deed of Trust with all the certificates mentioned along with the history of the property (antecedents), the information about the seller and the purchaser and all the information about purchase value, including the information related to the condominium regime, (if the property is a Condo or part of Home Owners Association / Strata) the registration of the condominium regime in the Public Registry. c) The Bank trustee will review the draft deed and all documents when accepted and send them back to the Notary to have them signed by the purchaser and the seller. d) Once signed by the seller and purchaser, the Bank Trustee will sign the deed, which then is registered in the federal Office of Foreign Investment e) The expenses related to the Trust are itemized in the closing cost estimate and correspond to federal government tariff / taxes to grant the ownership permit for a fixed fee (usually approx. 10,595 pesos for many Banks), which includes the formal registration of the trust. The bank reviews and give acceptance of the drafted deed of trust, and from the closing costs paid by the purchaser an advance payment equal to one year of the bank ́s fees is paid to hold the trust.

6) NOTARY FEES: These are the legal fees that the Notary will charge for the work done on your behalf. Normally, Notaries will charge from 0.75% to 1% or more of the purchase value for their own fees.

7) LEGAL COORDINATION FEES: These are the fees the Legal Team will charge for the work done on your behalf as a purchaser. Normally these fees are in the rage of $30,000 - $50,000 Pesos depending on the complexity of the file and additional services or documents needed to close.

8) THE IVA TAX: This is Value Added Tax - the equivalent of a sales and service tax in Canada or the United States; which is paid only on the Notary/ legal fees only, NOT the total closing cost estimate. In Mexico the sales / Value Added Tax is 16%.

Other items optional to the closing process in Mexico:

9) ESCROW: The Use of an Approved Escrow Service: When purchasing a property in Mexico, one of the most important issues to address for both a buyer and seller is how and under what conditions the funds will be safely handled and transferred. We always recommend using an Escrow company that can provide legal certainty for the transaction including proof of Insurance when holding the funds for a transaction.

Escrow is an independent 3rd party that holds the money according to the escrow agreement. Escrow Services provide security to a buyer as the seller does receive the sale proceeds until the deed is being signed, and other documents are verified including a no lien certificate (unless otherwise agreed).

The sellers receive funds from the Escrow Account only after the Legal Transfer process has completed in favour of the Purchaser, verifiable that the property is free of all liens and encumbrances. The fee for this service is typically $750 USD and the cost of setting up an Escrow account is born by the buyer.

In an international transaction this issue is even more important as it is often complicated, as both the purchaser and seller may not be comfortable having funds deposited in an unfamiliar jurisdiction or with an unfamiliar attorney or bank. USD can be held in escrow in the USA or Canada, without exchange into Mexican pesos

10) TITLE INSURANCE: It’s not customary in Mexico but, in addition to the above closing costs, a buyer can purchase title insurance through a title insurance company as per the custom in the USA.

It is in many ways redundant, as they will have to go through the process above described in all cases. Title insurance companies will first rely on the Notary title search and may, thereafter, do additional searches if needed. Bond: A performance bond is also another item buyers can purchase at their own expense and this is issued by a Mexican insurance firm and is on average about 1.8% of the value of the property.

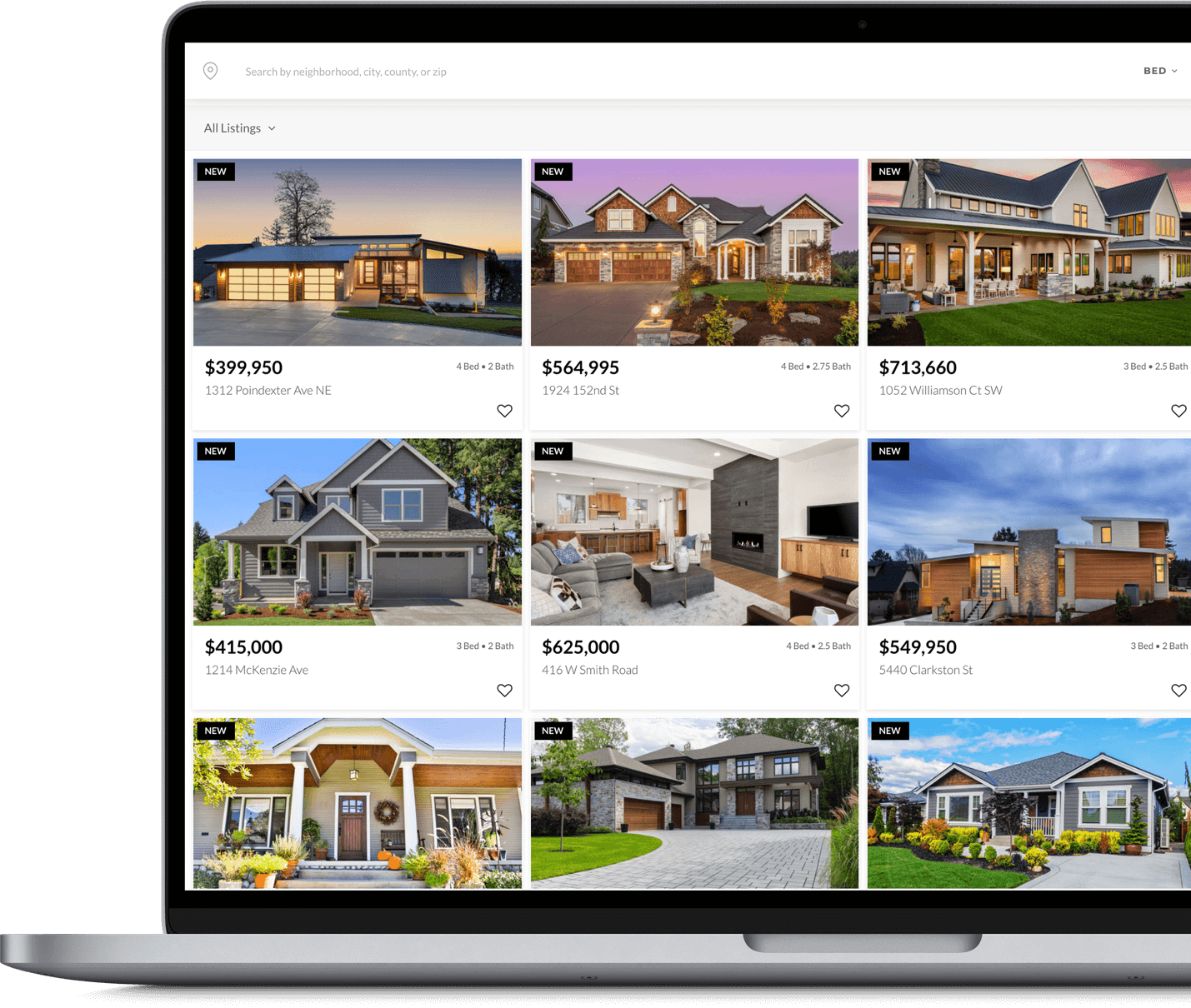

Start Your Home Search

Search for homes wherever you are

When buying a home, start by making a wish list and setting a budget. We can help you choose a lender to get you pre-approved for a loan, and then you're ready to start house hunting. Search for your dream home from any device on our website. You can even compare walk scores, school ratings, and neighborhood demographics for different listings.

Start Searching